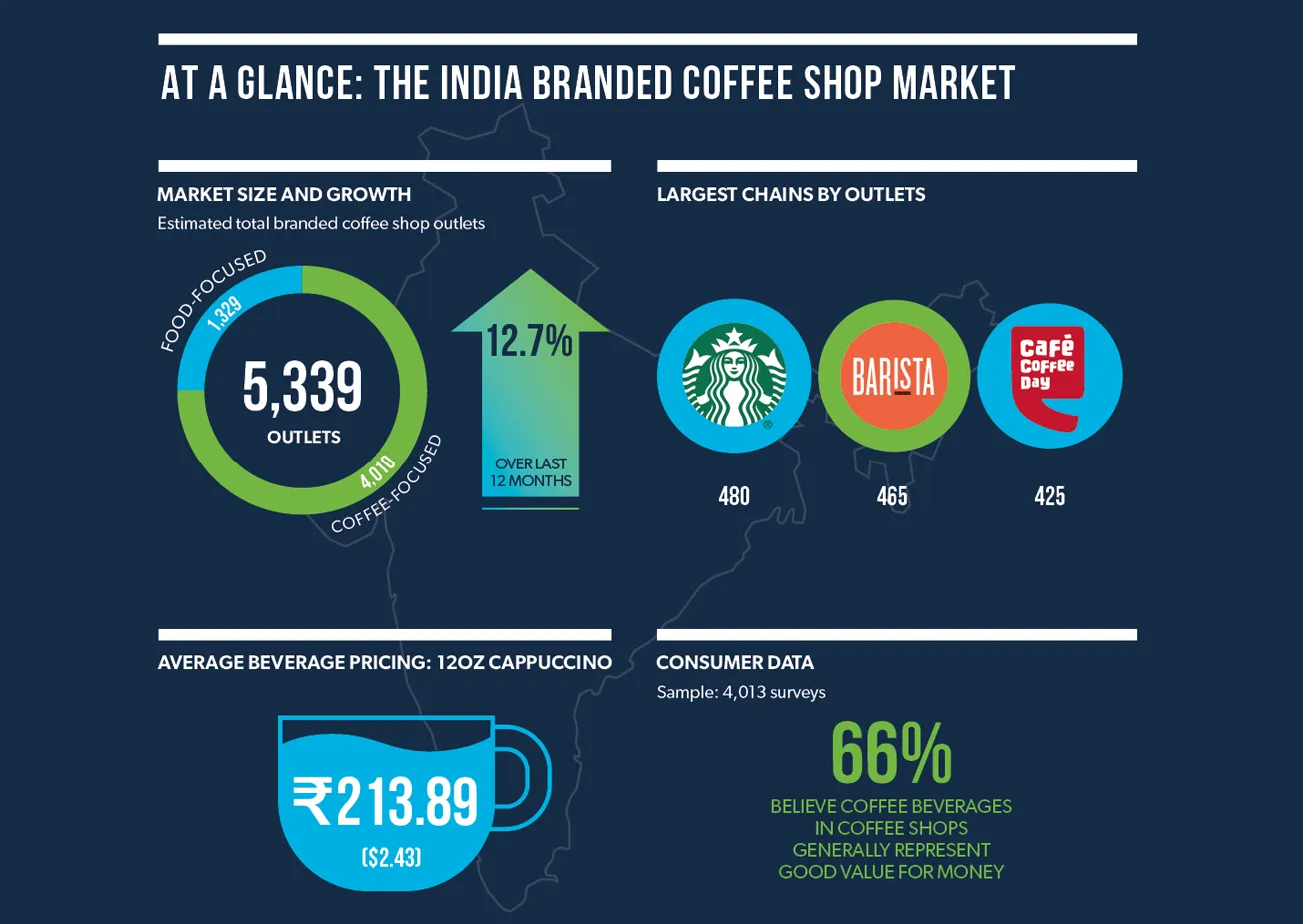

Project Café India 2025 is the world’s first deep-dive report on India’s burgeoning branded coffee shop market. It reveals the overall market grew 12.7% over the last 12 months to reach 5,339 outlets as both international and domestic operators vie for market share in the world’s most populous country

- Project Café India 2025 shows the total Indian branded coffee shop market added 600 stores (12.7%) over the last 12 months to reach 5,339 outlets

- Tata Starbucks (480 stores) is the market leader, followed by Barista (465 outlets) and Café Coffee Day (425 outlets)

- Indian consumers value in-store beverage consumption with friends and family over takeaway, with a third of branded coffee shop visits occurring after 5pm

- Younger urban consumers are driving demand for aspirational hospitality experiences

Indian branded coffee shop market primed for rapid growth

Espresso-based beverages and café culture are rapidly gaining ground in traditionally tea-drinking India. Twenty-four percent of 2,000 coffee shop consumers surveyed by World Coffee Portal now visit coffee shops daily, with 57% doing so at least once a week.

Indian consumers also have more choice than ever before, with the overwhelming majority of 104 coffee operators featured in this report achieving outlet growth over the last 12 months.

Starbucks, which entered India in 2012 via a partnership with domestic conglomerate, Tata Group, is the branded coffee shop market leader, with 480 stores commanding a 9% market share of outlets.

Unlock Allegra intelligence for just £1

Already have an account? Sign In