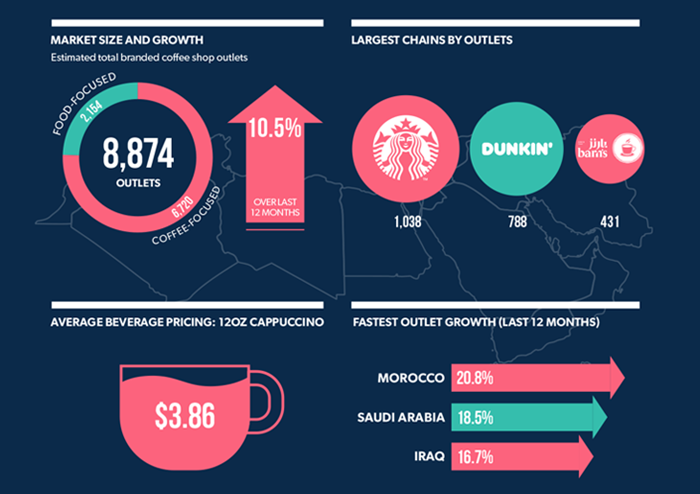

Project Café Middle East 2023 is World Coffee Portal’s strategic analysis of the Middle East and North Africa (MENA) branded coffee shop market*. It reveals the total market grew 10.5% over the last 12 months to reach 8,874 outlets, becoming a key geography for major international coffee chains and a new crop of domestic operators raising the bar for quality and service

Morocco, Saudi Arabia and Iraq are the fastest-growing branded coffee shop markets in the Middle East

- The total Middle East market grew 10.5% over the last 12 months to reach 8,874 outlets, with 12 out of 20 markets* adding stores

- Saudi Arabia is the largest Middle East market, growing 18.5% to reach 3,556 outlets and accounting for 40% of all stores in the region

- Morocco (20.8%), Saudi Arabia (18.5%) and Iraq (16.7%) are the fastest-growing markets by outlets

- The top 20 operators across the account for 60% of the total Middle East branded coffee shop market

Branded coffee shops continue to gain significant traction across the Middle East. Saudi Arabia and the UAE have become key hubs for growth and innovation as a rising tide of premium and specialty operators raise the bar for quality, service and choice across the region.

Twelve out of 20 Middle East and North Africa markets* featured in this report added outlets over the past 12 months, with Morocco (20.8%), Saudi Arabia (18.5%) and Iraq (16.7%) the fastest growing.

Convenience has grown to prominence, with app-enabled pick-up and delivery catering to a new generation of tech-savvy and affluent coffee consumers. Drive-thru is also gathering pace, with 30% of Middle East industry leaders surveyed identifying the format as a key consumer trend.

Saudi Arabia: The Middle East’s coffee powerhouse

Strong government investment, economic liberalisation, and social reforms are generating massive opportunities for both international and domestic coffee chains in Saudi Arabia.

Boosted by one of the world’s fastest growing developed economies, Saudi Arabia’s branded coffee shop market grew 18.5% over the last 12 months to reach 3,556 outlets, making it by far the largest in the Middle East.

Demonstrating its growing influence, Saudi Arabia has produced five of the largest 20 coffee chains in the region, with specialty operator Barn’s the third largest at 431 outlets. Major international coffee chains, including Starbucks, Dunkin’, Costa Coffee and Tim Hortons continue to harness strong demand for aspirational coffee shop experiences.

Starbucks store at Dubai Mall, UAE | Photo credit: Starbucks

Specialty coffee rises to prominence

A burgeoning specialty coffee market continues to boost mid-sized and independent operators in the Middle East, which are poised for further growth – 76% of consumers surveyed in Saudi Arabia and the UAE ordered from an independent café over the last 12 months.

Industry leaders surveyed believe growth in the speciality coffee is the most important consumer trend in the Middle East currently, where prominent brands, including Japan’s % Arabica, France’s Café Kitsuné, and the UK’s EL&N, have all gained footholds.

Indicating the growth of boutique brands is elevating quality across in the key Saudi and UAE markets, 74% of consumers surveyed indicate their coffee shop experience has improved over the last 12 months. Nearly a quarter of MENA industry leaders surveyed identified coffee connoisseurism as a key consumer trend.

Most Middle East markets weather global headwinds

Eight out of 20 Middle East markets featured in the report achieved double-digit outlet growth, with the majority adding outlets over the last 12 months.

However, Middle East operators have not been immune to rising inflation and supply chain challenges arising from Covid-19 from the war in Ukraine – 76% of industry leaders surveyed believe consumers are more price conscious than two years ago.

Israel’s fragmented domestic-led market shrank 0.4% to 1,308 outlets, with international coffee chains still struggling to gain a foothold. Meanwhile, grappling with economic crisis, political instability, and severe inflation, Lebanon’s branded coffee shop market contracted 6.3% to 194 stores.

Competition is also heating up as established coffee chains seek rapid growth and domestic independents seek to disrupt the market. Nevertheless, 80% of industry leaders surveyed indicate current trading conditions are positive, with just 10% anticipating trading conditions will deteriorate in the year ahead.

Middle East coffee chains set for sustained growth

With coffee consumption deeply rooted in Middle Eastern culture, most of the region’s branded café markets are likely to achieve healthy near-term growth as consumer appetite for aspirational hospitality experiences shows no sign of slowing.

World Coffee Portal forecasts the Middle East’s branded coffee shop market will reach 11,840 outlets in 2027, representing five-year growth of 5.9% CAGR.

The coffee-focused segment is predicted to grow at 6.5% CAGR over the next five years to exceed 9,190 outlets, while the food-focused segment is predicted to grow at 4.2% CAGR to exceed 2,640 outlets.

Commenting on the findings of Project Café Middle East 2023, Allegra Group Founder and CEO, Jeffrey Young said:

“The Middle East has become a veritable hot spot of activity for the global coffee shop industry, particularly in Saudi Arabia, where a strong economy boosted by high petrochemical prices and social reforms is enabling the coffee industry to boom.

“We expect growth to continue over the next three to five years as Middle East consumers build on an inherently strong coffee drinking culture to embrace a vibrant market of international brands and up-and-coming domestic operators.”

* Project Café Middle East 2023 provides market sizing for the following countries: Algeria, Iran, Kuwait, Oman, Syria, Bahrain, Iraq, Lebanon, Palestine State, Tunisia, Djibouti, Israel, Libya, Qatar, United Arab Emirates, Egypt, Jordan, Morocco, Saudi Arabia, Yemen

Report scope

Over 200 online surveys, consultations and in-depth interviews with leading industryinsiders, decision makers and key staff

Over 2,000 online surveys with coffee shop consumers in UAE and Saudi Arabia