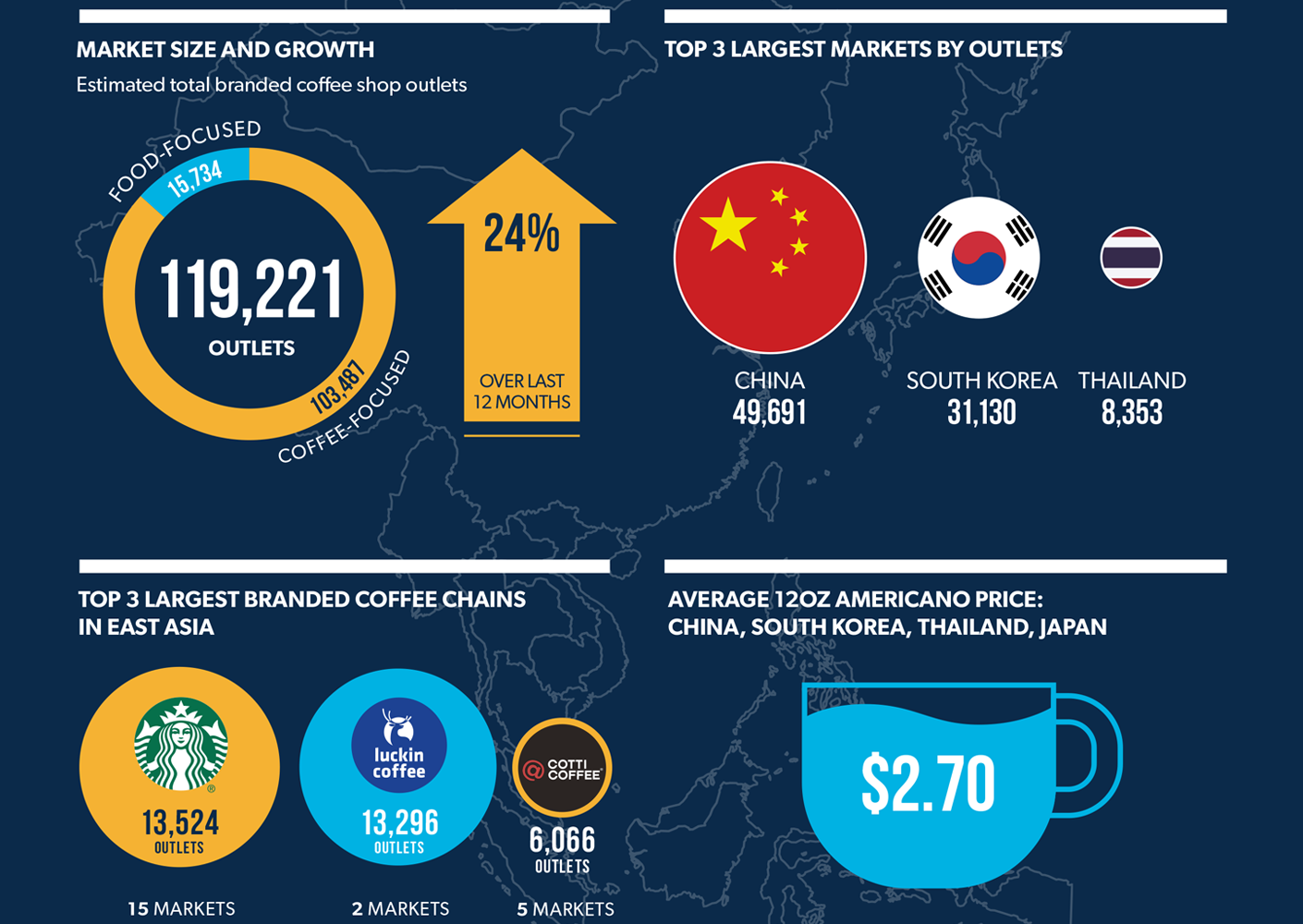

Project Café East Asia 2024, World Coffee Portal’s comprehensive analysis of the East Asian branded coffee shop market, reveals the total segment grew 24% by outlets over the last 12 months to reach 119,221 stores, with six of the largest 10 markets achieving double-digit outlet growth. Industry leaders surveyed across 18 East Asian markets broadly report positive trading conditions, rising sales and increasing opportunities for outlet growth in their respective markets

.png.aspx?lang=en-GB&width=700&height=496)

Download our infographic on the East Asian branded coffee shop market | Photo credit: © World Coffee Portal

- Project Café East Asia 2024 shows the total East Asian branded coffee shop market grew 24% in terms of outlets over the last 12 months to reach 119,221 stores, with China representing nearly 42% of the total market

-

17 out of the largest 18 East Asian markets achieved net outlet growth over the past 12 months, with seven markets experiencing double digit store growth

-

Eighty-five percent of the 645 branded coffee chains currently in operation across East Asia originate in the region with 95 operators from outside the continent

-

72% of East Asian industry leaders surveyed report increased sales over the last 12 months, with the same percentage believing trading conditions will further improve next year

China leads significant coffee shop growth across East Asia

China has overtaken the US as the largest branded coffee shop market in the world by outlets, growing 58% over the last 12 months to reach 49,691 outlets. Growth was led by the rapid expansion of small store format and delivery focused Luckin Coffee and Cotti Coffee, which added 5,059 and 6,004 net new stores respectively. Starbucks opened net 785 outlets in China during the period and is the second largest branded coffee operator in the country by outlets.

China is the fastest growing market in East Asia ahead of Malaysia (28%) and the Philippines (15.3%). Overall, six of the largest 10 markets by outlets achieved double-digit outlet growth over the last 12 months.

Starbucks remains East Asia’s largest coffee chain – but competitors challenge dominance

Starbucks remains the largest branded coffee chain in East Asia, having opened 1,223 net new outlets in the last 12 months to reach 13,524 stores across 15 markets. However, domestic operators such as South Korea’s Mega Coffee, Indonesia’s Tomoro Coffee and Malaysia’s Zus Coffee are challenging Starbucks’ dominance and increasing their market share.

As the total East Asian branded coffee shop market matures, rapidly expanding operators are increasingly seeking international growth opportunities. Cotti Coffee has entered South Korea, Indonesia, Japan and Hong Kong since opening its first store in China in 2022, while Luckin Coffee, Kopi Kenangan and Compose Coffee all opened their first international stores within the last 12 months.

Convenience key concern for Chinese coffee consumers

More than 90% of 4,000 Chinese coffee shop consumers surveyed drink hot coffee weekly, while 64% consume iced coffee at least once a week. Indicating the role of coffee shops in driving consumption, 89% of consumers surveyed visit or order from a coffee shop at least once a week with a fifth of those doing so daily.

Small format stores focused on convenience are widespread in the Chinese branded coffee shop market. More than 85% of those surveyed have pre-ordered or ordered for delivery from a coffee shop within the last 12 months, with 57% preferencing beverage delivery over visiting a coffee shop.

Industry optimism remains high with further sales and outlet growth on the horizon

The majority (72%) of industry leaders surveyed achieved annual sales growth in their respective markets, with the same percentage positive about current trading conditions.

World Coffee Portal forecasts the total East Asian branded coffee shop market will exceed 136,500 outlets by November 2024, and 181,500 by 2028 representing five-year growth of 8.8% CAGR.

China’s booming outlet growth is expected to slow to 24% in 2024 and 6% in 2028, while Indonesia, Malaysia and the Philippines are forecast to achieve double-digit outlet growth over the next three years.

Commenting on the report findings, Allegra Group Founder and CEO, Jeffrey Young said: “The East Asian coffee shop market is clearly experiencing rapid growth led by phenomenal outlet expansion in China, which has fast become a global coffee industry powerhouse. It is encouraging to see the established South Korean and Japanese markets continue to perform strongly alongside the growth of coffee culture in fast-developing markets such as Vietnam, Malaysia and Indonesia.”

Project Café East Asia 2024 is World Coffee Portal’s study of the 18 branded coffee shop markets across East Asia – Brunei, Cambodia, China, East Timor, Hong Kong, Indonesia, Japan, Laos, Macau, Malaysia, Mongolia, Myanmar, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam. Our research includes market sizing, consumer research, industry consultations and analysis of key market topics.

To purchase the report or to make an enquiry, contact:

Ruth Thompson, Head of Partnerships

rthompson@allegra.co.uk

+44(0)20 7691 8800