- Coronavirus disruption peaked in March 2020, with 90% of coffee shops reopened as of September 2020 – but operators now face a long road to recovery in a significantly altered market landscape

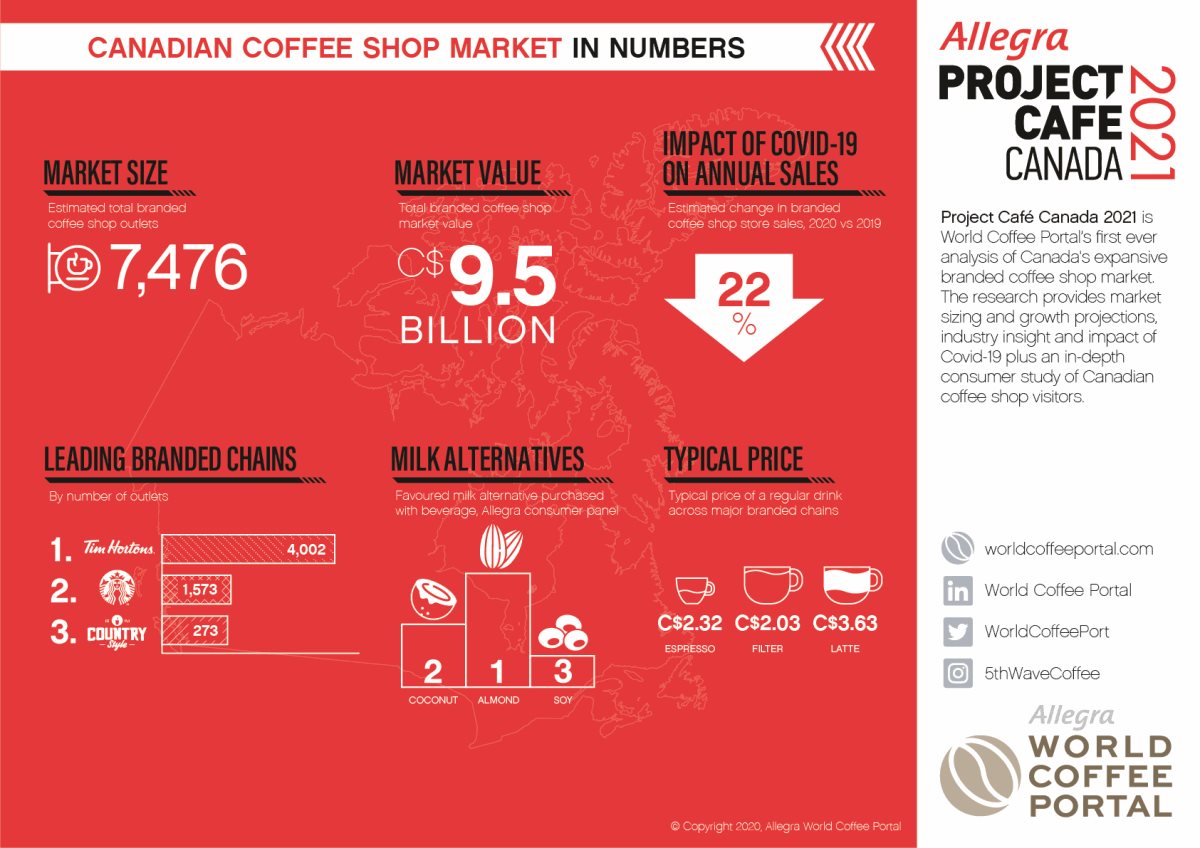

- Total stores sales estimated to exceed C$9.5bn in 2020, a 22% contraction since a peak value of C$12bn was achieved in 2019

- World Coffee Portal forecasts a return to outlet growth in 2023 following projected outlet decline of 1.2% in 2021

- Canada’s two largest coffee chains, Tim Hortons and Starbucks, comprise 75% of the total branded coffee shop segment

.jpg.aspx?width=700&height=494)

Due to unprecedented Covid-19 disruption, store sales across Canada's branded coffee shop market contracted by 22% in 2020, down from C$12bn in 2019.

Project Café Canada 2021, Allegra World Coffee Portal’s inaugural study on Canada’s rapidly developing branded coffee shop segment, reveals the C$9.5bn (US$7.2bn) market contracted by 10 net outlets (0.1%) in 2020 and now stands at 7,476 outlets, as coronavirus continues to impact hospitality businesses across the country.

Canada’s cafés re-open but face further hurdles ahead

Canadian operators reported an average 50% loss of revenue for the six months March-August 2020 – equating to C$27,786 in lost earnings per month – according to World Coffee Portal’s survey of industry leaders.

Indicating the coffee shop industry is now on the road to recovery, approximately 90% of Canadian branded coffee shops have resumed trading as of September 2020 – albeit with limited in-store service – following peak closures in March. 51% of industry leaders surveyed believe coffee shop trading conditions will improve over the next 12 months, but 22% forecast further deterioration.

Hand-sanitizer and social distance markers have been the most common initiatives deployed by operators to encourage the public to return to coffee shops, with 75% of industry leaders believing consumers should now feel safe in-store. However, with just 44% of Canadian consumers indicating they feel safe physically visiting coffee shops, operators have some way to go in rebuilding consumer confidence.

Canadian coffee shop market reshaped by Covid-19

Due to unprecedented Covid-19 disruption, store sales across the Canadian branded coffee shop market contracted by an estimated 22% in 2020, with the market now valued at C$9.5bn – a C$2.5bn sales decline on 2019.

Operators have sought to build new revenue streams by accelerating the introduction of cashless transactions, collection-only formats, such as Starbucks Pickup, and utilizing third-party delivery providers such as Door Dash and Uber Eats.

Drive-thru sites, which already account for over 40% of all branded outlets in Canada, have also proved invaluable for operators seeking to deliver physically distanced services during the pandemic, with the format already highly utilized by Canadian consumers.

Major chains dominate Canada’s branded café market

Holding a dominant 54% share of the domestic market, Tim Hortons is Canada’s biggest coffee chain. Underlining the chain’s significant brand loyalty, Tim Hortons was voted The Nation’s Favourite coffee shop among Allegra’s independent panel of consumers*, with consumers aged 55 and over rating the chain most highly.

Together, Tim Hortons and Starbucks hold a 75% share of Canada’s 7,476-store branded coffee shop market.

Under-35s leading a shift in Canadian coffee shop culture

Traditionally a nation of filter coffee drinkers, under-35s are leading the popularization of espresso-based beverages. 59% of this demographic believe a barista-prepared beverage adds value to their purchase, compared with 35% of those aged 55 and over.

Non-dairy options are becoming increasingly prevalent at coffee shops, with almond and coconut milk favoured by younger consumers. Coffee sourcing transparency is also gaining traction in Canada, with 47% of consumers agreeing it is important for them to purchase ethically sourced coffee where possible.

No return to outlet growth predicted until 2023

Covid-19 continues to generate significant uncertainty in Canada’s coffee shop segment. Assuming the pandemic is largely resolved during 2021, and a relatively swift economic recovery, Allegra forecasts the market will recover to C$10.5bn sales in 2021, an annual increase of 10.8%, and return to pre-pandemic levels by 2023.

Two further years of outlet contraction are expected before growth resumes and the current market size is exceeded by 2024. World Coffee Portal projects total market sales will approach C$13bn across 7,600 branded chain outlets by 2025.

Commenting on the report findings, Allegra Founder and CEO, Jeffrey Young, said:

“After facing a difficult double-digit sales decline in 2020, the Canadian coffee shop market is forecast to hold steady over the next 3-5 years.

“Drive-thru has clearly been hugely beneficial for operators facing trading restrictions during the pandemic. Canadian coffee shops will benefit further from introducing cashless transactions, pick-up and delivery services to help consumers feel safe.

“With the market currently dominated by branded chains, we expect to see local independents taking a greater share of suburban trade as Canadian consumers seek to diversify their coffee tastes.”

* Based on an independent consumer panel of over 2,000 Canadian coffee shop visitors

.jpg.aspx?width=700&height=149)