Independent coffee shops face formidable challenges in the UK’s toughening retail climate, but those distinguished by outstanding coffee, superb food and pitch-perfect service have the potential to usher in the next era of UK coffee excellence

As estimated 10.5 million cups of coffee are served in UK independent coffee shops per week

As estimated 10.5 million cups of coffee are served in UK independent coffee shops per week

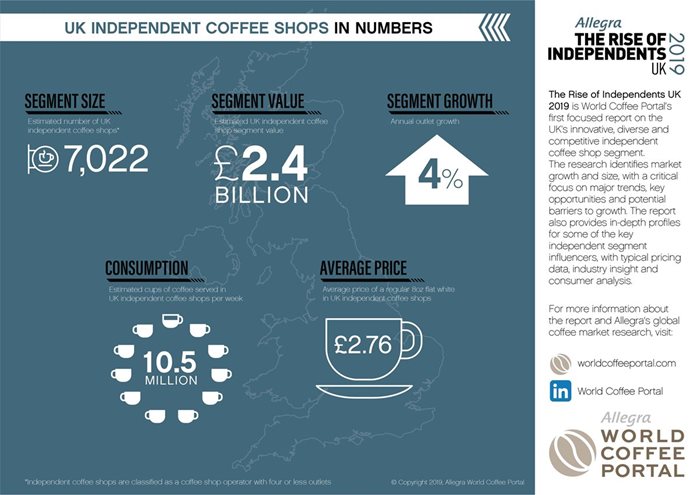

The Rise of Independents UK 2019 is World Coffee Portal’s first dedicated report on the UK’s challenging yet highly innovative independent coffee shop segment. The research reveals 7,022 independent cafés operating in the UK, with an estimated value of £2.4bn.

The report records 4% annual outlet growth for UK independents over the last 12 months, representing an estimated 260+ net new sites. Allegra forecasts the segment will exceed 8,000 outlets by 2024, growing at 3% CAGR.

Allegra estimates UK independents serve more than 10.5 million cups of coffee each week. But with branded chains often competing on location, convenience and price, independents need to ensure their proposition is pitch-perfect every time to entice premium consumer spend.

Independents more vulnerable to market headwinds, but industry leaders remain upbeat

Rising labour costs and property costs are perceived as the greatest challenges facing independent coffee shops in the UK, ahead of business rates, and increasing competition. Despite the challenging retail environment, 80% of independent coffee shop leaders surveyed by Allegra in March 2019 reported positive sales performance in the last 12 months, with a majority citing coffee and service quality as key success factors. Three-quarters of industry leaders surveyed believe there is still plenty of growth potential for independent coffee shops in the UK.

Independents must capitalise on elevated in-store experiences, higher dwell times and product innovation to remain competitive

Allegra research shows more than 70% of independent café consumers surveyed purchase coffee to drink in-store compared to 56% of branded chain customers. A further 21% of consumers surveyed choose independent coffee shops based on service quality, compared to 16% at branded chains. Similarly, 18% view atmosphere as greatest impetus behind visit compared to just 8% at branded chains. This indicates independents can compete effectively with highly refined, personalised in-store experiences that foster neural loyalty through community-based concepts.

Longer dwell-times also present an opportunity for menu diversification, such as single origin coffees, non-dairy milk and vegan options, which are more likely to appeal to consumers under-30s. Forty percent of this group surveyed indicate they are drinking more coffee at independents compared to a year ago, making them a key marketing demographic.

Commenting on the research, Allegra CEO and Founder Jeffrey Young said:

“There’s no doubt independent coffee shops face an uphill struggle compared to scaled competitors, particularly in today’s highly challenging retail environment. But those independent cafés defined by razor-sharp menu quality and seamless, highly personalised hospitality face a very bright future indeed. I’m highly excited to see what the innovation a new generation of independent businesses bring to the market over the next few years.”

The Rise of Independents UK 2019 is Allegra World Coffee Portal’s inaugural focus on the health and future viability of the UK independent coffee shop segment. |