Based on exclusive data from World Coffee Portal’s Project Café UK 2022 report, 5THWAVE examines five key market dynamics shaping Europe’s largest branded coffee chain market in 2022 and beyond

.jpg.aspx?lang=en-GB&width=700&height=466)

Greenwich Grind, London | Photo credit: Grind

In early 2021, UK branded coffee chains were reeling from Covid-19 disruption that had wiped out nearly £2bn ($2.7bn) of market value. However, 12 months on the sector has once again proved its resilience, navigating sustained uncertainty to achieve a £1.3bn sales rebound, representing 43% growth.

The total UK branded coffee chain market is now valued at £4.4bn having recovered to around 87% of its pre-pandemic value. Meanwhile, the number of outlets has surpassed 2019 levels, growing 3.5% to reach 9,540 stores.

In a further sign of the market recovering from the pandemic, most operators have achieved year-on-year growth, with 55% experiencing a sales uplift of more than 5%. Industry leaders are also more optimistic, with 56% indicating the current trading environment is positive, up from just 15% in the year previous. Seventyfive percent surveyed expect trading conditions to improve over the next 12 months.

But despite the positive turnaround, UK coffee shops will face significant challenges from inflation, lower consumer spending and the ongoing threat posed by Covid-19. The UK market is also undergoing shifts in the way coffee shops do business, with app-based delivery, click & collect and drive-thru stores all on the ascendence.

Here are five key market dynamics that look set to shape the future of the UK branded coffee chain market.

1. Covid-19, VAT and staff shortages

After a summer of relative trading normality in 2021, the emergence of the Omicron variant in December 2021 highlighted the unpredictability of the pandemic, with the possibility of new Covid-19 waves looming over hospitality businesses in 2022.

While Omicron lost intensity in early 2022, its quick and sharp impact on the traditionally busy Christmas period was a blow for hospitality businesses that is still being felt.

Office of National Statistics (ONS) data shows the number of seated diners in the UK on 20 December was 22% down on 2019 levels. Meanwhile, footfall data from Wi-Fi provider Wireless Social indicated a 34% decrease in hospitality footfall in mid- December 2021 compared to 2019.

Covid’s impact on travel hub footfall also remains pronounced, with uncertainty surrounding the recovery of commuter footfall. UKbased travel concession operator, SSP Group, which controls prominent brands including Upper Crust and Caffè Ritazza, reported 2021 revenues remained 70% down on 2019 levels.

The hospitality sector has been hit by severe staff shortages driven by the pandemic and exacerbated by the curtailment of European workers after Brexit

Nevertheless, just 16% of industry leaders surveyed believe Covid-19 will have a long-term negative impact on out-of-home coffee demand, down from 33% in 2020.

Operators also face the planned reinstatement of VAT from 12.5% to 20% in April 2022, marking the removal of key government assistance for hospitality businesses. Coupled with the rising cost of living, higher import costs, supply chain disruption and squeezed consumer income, this already thin sales margin could further be eroded in the year ahead.

Meanwhile, a severe shortage of hospitality staff driven by the pandemic and exacerbated by the curtailment of European workers after Brexit presents another significant headwind for UK coffee shops. Just 6% of industry leaders surveyed by World Coffee Portal feel more confident about Brexit and its impact on the hospitality industry than 12 months ago.

Many hospitality businesses have increased wages in a bid to attract staff, with recruiter Indeed showing UK hospitality wages grew by 4.6% in 2021 – higher that the 4.3% national average recorded by the ONS.

Reflecting the climate, Costa Coffee raised retail staff pay by 5% in 2021, with Pret A Manger announcing shortly after that more than 85% of its staff would earn at least £10 per hour from April 2022 – its second pay increase announced in four months.

In the longer term, these combined factors could compel operators to raise prices, with further store closures and redundancies a very real possibility in 2022.

2. Increased digital integration, delivery and drive-thru

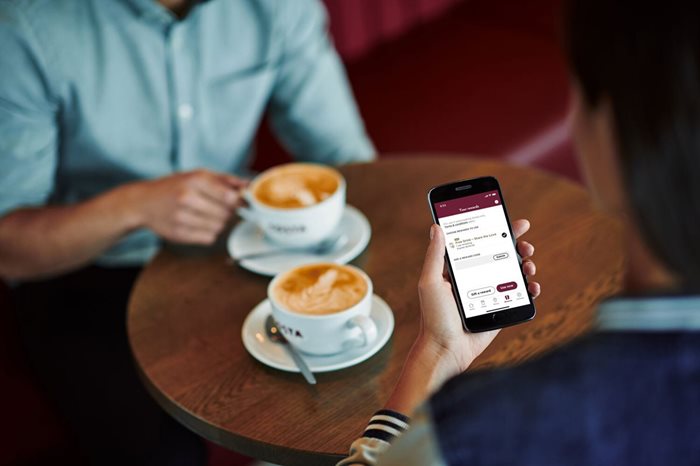

In the wake of sustained Covid-19 trading disruption over the last 18 months, digitally enabled services, such as click & collect, delivery, and beverage subscriptions have gathered pace in the UK coffee shop market. UK consumers appear to be embracing digital interactions with coffee shops. 61% surveyed indicated they had downloaded a coffee shop app, with 36% purchasing a beverage to collect from a coffee shop over the last 12 months.

A growing number of operators have invested in beverage delivery, including Costa Coffee, which in February 2021 partnered with Deliveroo to launch a trial at 500 of its UK stores. Meanwhile, Greggs has significantly expanded its third-party delivery partnership with Just Eat to 1,000 stores. Boutique bakery chain, Gail’s, has also introduced delivery in London, a proposition it credited with boosting its full-year profits.

Eying an opportunity, Kuwait-based COFE App, a third-party app that connects users to existing coffee chains for delivery and pick-up, has announced plans to launch in the UK in 2022.

61% of UK consumers surveys indicated they had downloaded a coffee shop app, with 36% purchasing a beverage to collect from a coffee shop over the last 12 months

While just 16% of consumers surveyed have ordered beverage for delivery over the last 12 months, nearly a quarter (24%) would be open to beverage delivery if the option were more readily available. Challenges surrounding spillage, temperature and cost must also be addressed.

Elsewhere in the market, coffee shop subscriptions have been deployed by a handful of brands to encourage in-store visits. UK coffee chains Pret A Manger, Leon, Pure and Soho Coffee Co., the latter of which significantly expanded its online store in 2021, have all introduced coffee subscriptions over the last 12 months.

Drive-thru is also on the increase with the market now comprising 578 stores. Market leader Costa Coffee has added 75 locations since 2020 for a total of 275. Starbucks operates 270 sites and Leon opened its first drivethru store in 2021. Highlighting the commercial potential of the format, 57% of UK consumers surveyed say they would purchase beverages from a drive-thru if the facility were more readily available.

3. A continued focus on environmental sustainability

Sustainability remains high on the agenda for UK coffee shop consumers. A poll conducted by World Coffee Portal and UK Coffee Week in October 2021 found 69% surveyed believed the sustainability of coffee supply chains was an important factor when making a coffee shop purchase.

Packaging waste, carbon footprint reduction and sending fewer recyclables to landfill were cited by UK industry leaders surveyed as the top three issues they felt most important for coffee shops to tackle.

The issue of disposable coffee cup waste has continued to gained prominence in the UK, where 2.5 billion are used every year and just one in 400 is recycled. To combat the waste, Starbucks trialled a reusable cup-sharing scheme across the UK, France and Germany in 2021, with a view to scaling the initiative to all its EMEA stores by 2025. As part of efforts to reduce single-use cup waste, the Seattle-based coffee chain has also reintroduced a £0.05 charge for single-use cups in the UK.

In a similar move, UK market leader Costa Coffee began trialling its own reusable cup scheme in the UK in September 2021.

69% of UK consumers stated the sustainability of coffee supply chains was an important factor when making a coffee shop purchase

Reducing carbon emissions from operations, including by reducing the use of dairy milk, has also climbed the agenda for UK café chains. In 2022, many operators may seek to increase operational efficiencies to reduce their impact and lower costs – an espresso machine using 10,000 kWh per annum is responsible for carbon emissions of 2.92 tons – more than a return flight from London to Costa Rica. With energy costs forecast to rise significantly in 2022, coffee shops also stand to make large overhead savings from introducing operational efficiencies.

In May 2021, Costa Coffee partnered with InstaVolt, one of the UK’s largest owner-operated rapid EV charging networks, to install EV rapid chargers at 200 new and existing drive-thru sites in the UK, more than doubling its existing portfolio of 176 charging points.

The following September, mobile café and coffee van franchise provider Café2U pledged to convert its 100-vehicle fleet to electric over a five-year period, a plan it said would reduce its carbon emissions by 12,672 tons per year.

However, highlighting the commercial dilemma for many operators when introducing sustainability initiatives, 54% of industry leaders surveyed agreed that doing so comes at the expense of profits. Indicating that coffee shops have much work to do, just 28% surveyed felt the industry can be proud of its sustainability efforts, down from 58% in 2020.

4. The growing popularity of plant-based alternatives

Consumer focus on health & wellness and the environment continues to drive growth in dairy alternatives across UK coffee shops. Indicative of the trend, in January 2022, Starbucks said it would no longer charge £0.40 extra for dairy alternatives in its beverages. The removal of the charge brought the Seattle-based coffee chain in line with UK market leader Costa Coffee, which removed its plant-based surcharge in 2019. Food-to-go and coffee chain Pret A Manger followed suit in 2020 by removing its own £0.40 surcharge.

World Coffee Portal research shows oat is now the UK’s preferred dairy alternative in UK coffee shops, overtaking the previous favourite, coconut. Underlining the trend, in late 2021 Starbucks launched its new ‘oat latte platform’, a range of coffee beverages intended to optimise the flavour of oat dairy alternatives.

Further highlighting the growing market for plant-based dairy alternatives in the UK, in November 2021, Belgium-based Alpro completed a £23m ($30m) upgrade to its production facility in Kettering, which is now capable of producing 300 million litres of plantbased beverages annually. Swedish competitor, Oatly, has also announced plans open a new UK production site by 2023.

However, despite the sustained rise of dairy alternatives in the UK, dairy milk remains the firm favourite among UK consumers surveyed.

Sixty percent indicated they had tried semi-skimmed milk in a coffee shop over the last 12 months, with 33% opting for whole milk and 27% trying skimmed milk.

Costa Coffee, Starbucks and Pret A Manger have all removed the surcharge on dairy-alternative milks in beverages

5. Further growth of boutique 5th Wave coffee brands

Coffee shops continue to be an intrinsic part of communities and daily routines across the UK. Meanwhile, sustained consumer interest in higher quality at-home coffee and premium equipment looks set to elevate standards across the market.

World Coffee Portal anticipates this focus on quality will encourage further scaling of boutique concepts, with 5th Wave coffee shops finding new audiences among increasingly savvy and coffee-loving consumers.

After having successfully navigated the pandemic with click & collect, retail partnerships and delivery, boutique bakery and café chain, Gail’s posted increased profits in 2021 and continues to scale up in London and the Southeast of England.

London-based Grind has also found success tapping into the retail coffee market as well as a partnership with private members club group, Soho House. In August 2021 the café, restaurant and bar group attained £22m ($31m) investment to grow its at-home coffee business and facilitate new store openings in the US.

Meanwhile, building on its St Pancras International site opened in 2020, boutique café chain EL&N opened a store at Heathrow airport and has indicated that it may open more travel hub stores in the future. The brand has also opened its first international site in Dubai, UAE.

Project Café UK 2022, World Coffee Portal’s definitive report on the UK branded coffee shop market, gathers market insight from more than 50,000 consumer surveys and 150+ interviews with key UK industry leaders

This article was first published in Issue 9 of 5THWAVE magazine.