Covid-19 has caused extraordinary upheaval for Europe’s branded coffee chains over the last 12 months, with nearly half of the continent’s coffee shop markets experiencing net stores declines. While many of Germany’s sizeable bakery-led coffee chains were able to remain open as essential businesses during Covid-19 lockdowns, the branded coffee chain market has endured a significant downturn that will take several years to rebound

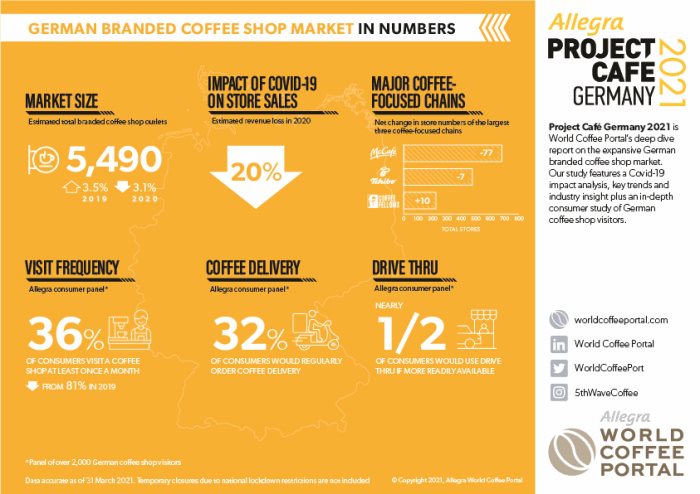

2020 saw an estimated 20% drop in sales revenue across the German branded coffee shop market, and a 3.1% contraction in outlets | Source: Project Café Germany 2021

The German branded coffee shop segment performed more favourably than most European markets in terms of sales revenue in 2020, but still declined by 20% on average. It now contains 5,490 branded coffee shop outlets, with the total market contracting by net 174 stores or 3.1%.

Highlighting the profound disruption Covid-19 has caused across Europe, 76% of German operators surveyed reported a comparable sales decline in 2020. More than half (52%) believe the worst Covid-19 disruption is over, but 21% still anticipate further deterioration over the next 12 months.

The German coffee shop market is characterised by a strong bakery presence. Food-focused chain, K&U Backkultur is the overall market leader with 802 outlets, having added net 48 stores in 2020. Many of Germany’s food-focused coffee shop chains have avoided the worst restrictions of the pandemic as bakery-led operations were permitted to stay open as essential businesses.

With such a strong presence of pastries, breads and baked goods in the German market, it is unsurprising that indulgence remains the biggest impetus for consumers to visit coffee shops. Of the consumers surveyed across Europe, German coffee shop visitors are among the least likely (27%) to be influenced by beneficial health claims when making a coffee shop purchase.

More than half (57%) of German industry leaders surveyed by World Coffee Portal believe coffee shop consumers can feel safe from Covid-19 while visiting coffee shops, although this proportion is relatively low compared to many European countries.

Half of German consumers would be willing to use a drive-thru service if they were more readily available

Nevertheless, German coffee shops have invested significant resources in digitising coffee shop transactions to minimise physical interaction, including online and app-based ordering, as well as e-shops for at-home coffee products.

Operators seeking to catalyse new sales strategies in the wake of Covid-19 should heed increased consumer desire for delivery and drive thru in Germany. Thirty-two percent of German consumers surveyed indicate they would be willing to order hot beverages for delivery if the option were more readily available, up from 24% the year previous.

The pandemic has also boosted appetite for drive-thru in Germany, with 50% willing to purchase coffee via the format if it were more readily available, up from 32% the year previous.

Germany’s highly developed coffee shop market was already experiencing a slowdown before the pandemic struck, with World Coffee Portal forecasting outlets will not return to pre-pandemic numbers within the next five years, with a CAGR decline of 0.4% over the period.

Project Café Germany 2021 is World Coffee Portal’s annual deep-dive study into Germany's expansive branded coffee shop market.

The report features market sizing and growth forecast, Covid-19 impact analysis, industry insight, and a consumer study featuring over 2,000 German coffee shop visitors.