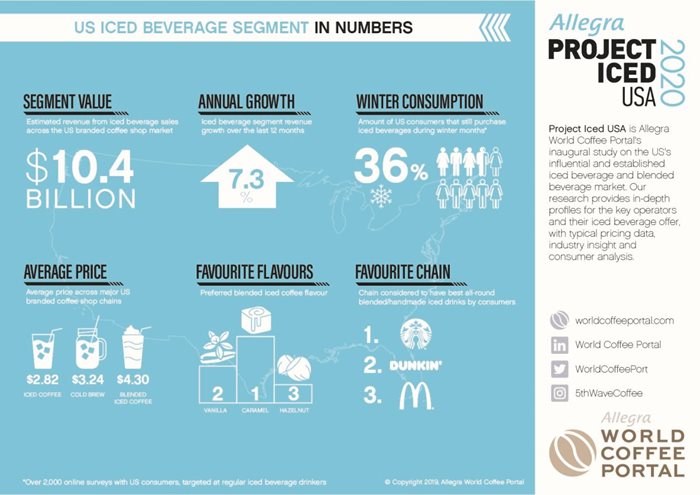

Project Iced USA 2020 is Allegra World Coffee Portal’s debut focus on the fast-growing and highly opportune US out-of-home iced beverages market. The report reveals iced beverages generated $10.4bn sales at US branded coffee shops during the last 12 months, achieving exceptional 7.3% growth

- Iced beverage sales comprise more than one fifth of $47.5bn US branded coffee shop revenues and now outpace hot coffee sales growth, which increased 4.6% during the period

- 91% of industry leaders surveyed believe the iced beverages sales environment in the US is positive. 92% report improved iced beverage sales over the past year

- Branded chains are driving the popularisation of iced beverages. More than 90% of US consumers surveyed purchased an iced coffee beverage at either Starbucks, Dunkin’ or McDonald’s in the last year

US consumers embracing cold brew

The development of cold brew represents one of the US coffee industry’s major innovations in recent years. The product is now a mainstay of most major coffee operator menus, gaining significant traction among consumers, particularly among younger demographics. More than 80% of industry leaders surveyed identified cold brew as the fastest growing product in coffee shops. More than 90% expect cold brew will become a mainstream staple within the next three years.

The introduction of nitro cold brew coffee experienced more modest success, is less widely available and yet to permeate the mainstream. Nevertheless, 62% of industry leaders surveyed believe nitro coffee will become a coffee shop staple within the next three years, with market leaders, Starbucks, Dunkin’, and Tim Hortons all offering the product.

Marketable iced beverages connect with consumers

Iced beverages typically command a higher ticket price than hot coffee options, greater customisation potential and enhanced marketability due to their distinctive appearance. Ready-to-drink (RTD) iced coffee is also proving popular with consumers, with a growing number of US operators, including Starbucks, Caribou Coffee, Stumptown Coffee Roasters and Bluestone Lane launching branded (RTD) products. Overall, more than 90% of US industry leaders surveyed report consumers are more willing to purchase iced beverages out-of-home than 12 months ago.

Continued growth expected for iced beverage segment

Despite wider retail headwinds in an increasingly competitive marketplace, Allegra forecasts the iced beverage segment will continue to prosper, with sales annual sales growth of 6.6% to $11.1bn expected in 2020. Growth will be led by the coffee-focused sub-segment, which is expected to surpass $10bn within the next 12 months. The potential for growth exists for branded operators who innovate and build on the diversity of their iced beverage ranges. Operators who are yet to embrace iced options could invigorate their offer by incorporating these products into their stores.

Project Iced USA 2020 is World Coffee Portal's inaugural study on the US’s established iced and blended beverage market. Our study identifies category sizing and growth projections and features an in-depth consumer analysis

Project Iced USA 2020 is World Coffee Portal's inaugural study on the US’s established iced and blended beverage market. Our study identifies category sizing and growth projections and features an in-depth consumer analysis.